“Stagflation fears continue to stalk the UK economy as hot wage growth limits the dose of monetary medicine the Bank of England will likely be able to administer. The ailing labour market could use a shot in the arm amid warnings of job cuts and hiring freezes ahead of April’s minimum wage rise and National Insurance hike. But with pay growth running at 6% in December, concerns over inflation persistence mean rate setters continue to signal only gradual interest rate cuts, despite the economy hovering on the edge of recession.

The Indeed Wage Tracker indicates strong pay pressures continued into January, with posted wage growth running at 6.1% year-on-year. Pay pressures are running around double the levels consistent with sustainably keeping inflation at the Bank’s 2% target, giving policymakers an ongoing headache.

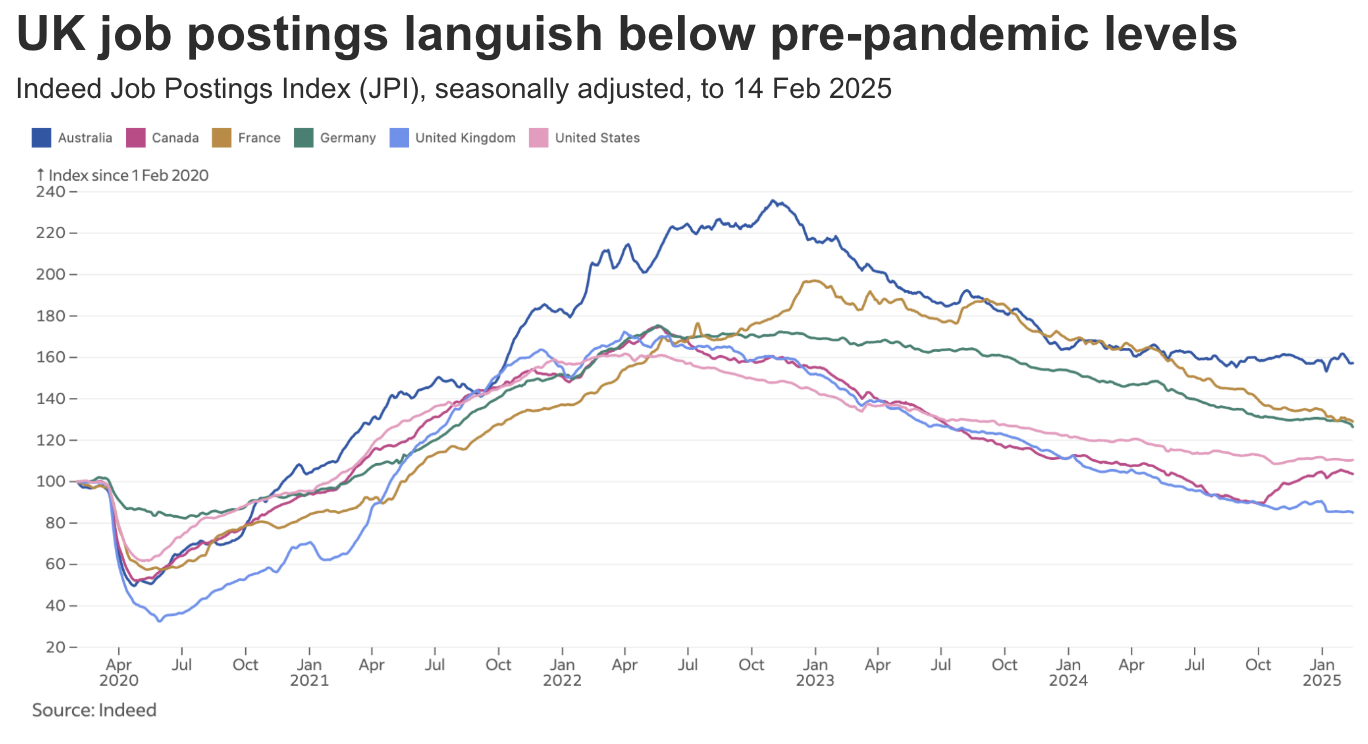

Real time job postings data shows hiring demand remains soft but at least isn’t getting any weaker. UK job postings have broadly trodden water since October’s Budget, remaining 15% below pre-pandemic levels as of mid-February. Employers continue to sit on their hands amid uncertain economic prospects, with few having confidence to dial up hiring in the current climate.”