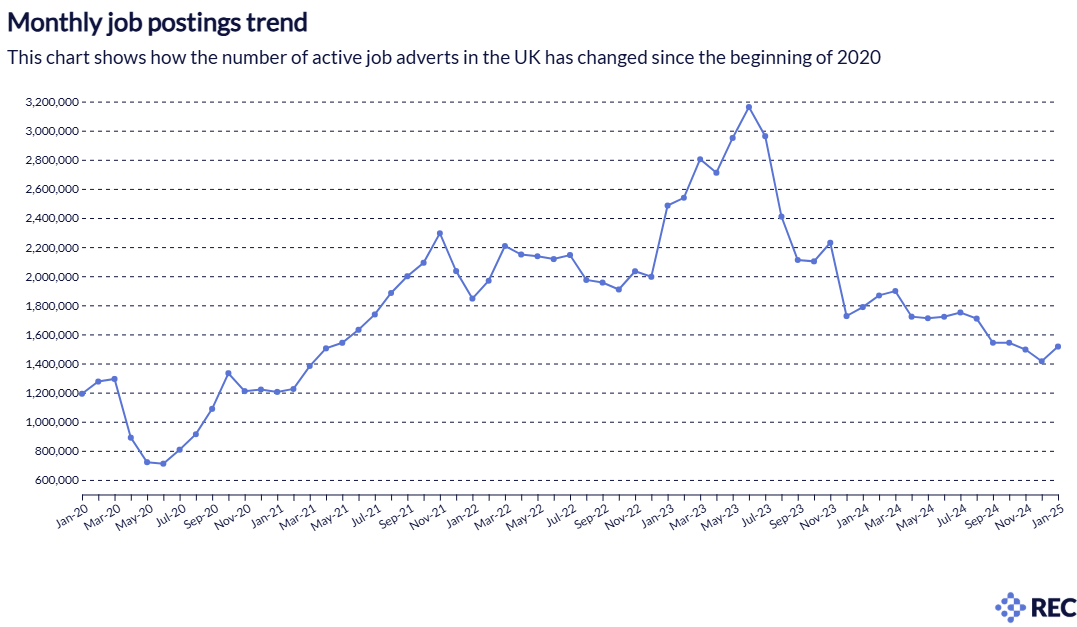

- The number of overall active job postings in January 2025 was 1,516,535 – an increase of 7.2% on the number of job postings in December 2024. This marks the first time that job postings have risen since June 2024.

- Every region in the UK saw a rise in active job postings, the largest rise was in the East Midlands (11.7%) and the smallest was in London (3.4%).

- The number of new job postings in the UK was 738,040 – up by 34.4% on a sluggish December 2024. This compares favorably to the 27.9% increase in new postings in January 2024 compared to December 2023.

There was an increase in job postings across the UK in January 2025, according to the latest Recruitment and Employment Confederation (REC)/ Lightcast monthly Labour Market Tracker.

The January 2025 figures show employers coming back to the job market as the new year begins, despite economic challenges, and indicates cautious optimism in some sectors. But this does not necessarily signal a broad or fast recovery.

It is a bright spot in a week of difficult news about the UK economy.

The number of overall active postings in January 2025 was 1,516,535. The number of new job postings in the UK was 738,040 – up by 34.4% on a sluggish December 2024.

REC Deputy Chief Executive Kate Shoesmith said:

“While there are tough conversations going on in boardrooms across the country, today’s report suggests it is too soon for gloom about the UK economy’s prospects overall for 2025. The increase in job postings is a clear sign that employers will hire when they need to. A 34.4% increase in new jobs signals a solid rebound in demand, showing that businesses remain resilient, despite both domestic and international headwinds. We will look closely in the coming months to see if we are looking at a broader turn.

“The government’s increased focus on economic growth is encouraging, but fostering business confidence requires tangible actions, not just rhetoric. Ongoing fiscal uncertainty, looming national insurance increases, and a potentially burdensome employment rights framework may yet dampen momentum. For real growth, businesses need a clearer strategy on how government industrial policies will truly drive economic progress.”

Today’s Labour Market Tracker shows an increase in job postings this month for Stonemasons and Related Trades (47.9%), Gardeners and Landscape Gardeners (45.3%) and Travel Agents (43.0%).

Delivery staff saw the largest decrease in the number of job postings in January 2025. This aligns with reasonable estimates, as the demand for parcel delivery declines post-Christmas. The sharpest declines were found in: Roundspersons and Van Salespersons - who deliver and sell goods - (-30.4%); Postal Workers, Mail Sorters, Messengers and Couriers (-47.4%); and Delivery Drivers and Couriers (-73.4%).

East Derbyshire (43.8%), East Dunbartonshire (27.4%) and Antrim and Newtownabbey (22.8%) showed the highest increase in job postings. Whereas Brent (-5.1%), Fermanagh and Omagh (-7.3%) and Dumfries and Galloway (-15.7%) all accounted for the sharpest decline in job postings.

Sectors

Information Technology

Overall, the sector had an 1.3% increase in the number of job postings from December 2024 to January 2025. The IT roles with the biggest increases were: IT Quality and Testing Professionals (15.6%); Data Entry Administrators (6.3%); and IT Network Professionals (4.6%). This follows the REC’s analysis of annual data in 2024 which found that IT roles saw among the biggest decrease in demand.

Construction

There were over 100,000 job postings in construction in January 2025. This is a 13.2% increase from December 2024. Overall, most construction jobs saw an increase in January 2025 as compared to December 2024. The following were the roles with the biggest increase: Stonemasons and Related Trades (47.9%); Steel Erectors (22.6%); and Carpenters and Joiners (20.5%).

Retail

In January 2025 there were over 160,000 job posts in the retail sector. This is an increase of 3.9% as compared to December 2024. Most roles in the retail sector saw an increase in job postings, including Collector Salespersons and Credit Agents (32.7%), Customer Service Supervisors (16.7%) and Telephone Salespersons (16.6%). But among the biggest decreases were found in Sales and Retail Assistants, down a further 8.4% in January 2025 as compared to December 2024. This follows December 2024’s (as compared to November 2024) fall of nearly a quarter (-24.7%).

The fashion and textile industry in the UK has spoken of its desperation for support to recruit, tackle skills shortages and build a talent pipeline for the future to support future growth. Ahead of London Fashion Week, next week, REC can reveal some of the opportunities in the fashion sector right now. For example, in January 2025 there were 2,369 job postings for Textile Process Operatives, 288 job postings for Clothing, Fashion and Accessories Designers, 165 job postings for Tailors and Dressmakers and 171 job postings for sewing machinists. When grouping these roles together along with Footwear and Leather Working Trades and Textiles, Garments and Related Trades n.e.c., we see a steady reduction in job postings, from the recent collective highs of just below 6,000 job postings in mid-2023 down to the mid-3,000s so far in 2025. This fall is driven by a near halving of job postings for Textile Process Operatives and tailors and dressmakers. And a less but still significant drop in job postings for Sewing Machinists and Clothing, Fashion and Accessories Designers today compared to mid-2023. That said, demand for such roles do undulate a fair amount within and between years. This suggests that the UK fashion industry faces a delicate balance between needing talent and struggling with recruitment challenges. And while demand may be static or lessening, the skills are still needed and in some cases the lack of them is unhelpful for keeping manufacturing in the UK.