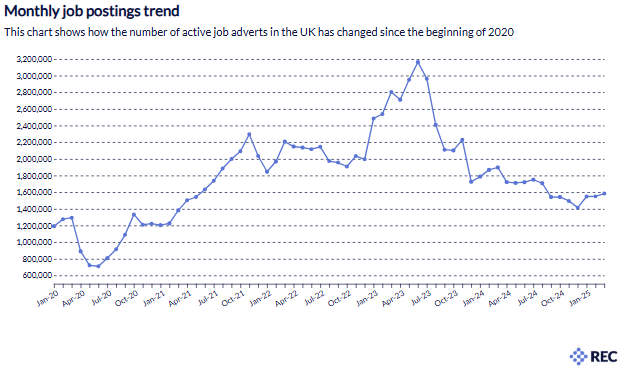

- The overall number of active job postings in March 2025 was 1,583,465– an increase of 2.3% on the number of job postings in February 2025.

- When comparing regions Scotland (4.6%) again had the highest increase in the number of job postings and London follows with a 4.4% increase, whereas the only decrease was in Northern Ireland (-3.3%).

- The number of new job postings in the UK was 749,311 – up by 10.3% on February and returning the trend to January levels.

The job market has seen consistent demand this Spring with postings across the first quarter of the year showing resilience, although at a lower level than previous years according to the latest Recruitment and Employment Confederation (REC)/ Lightcast monthly Labour Market Tracker.

The stabilising of the job market in March 2025 will be tested by rising costs of employment in April as Employer’s National Insurance Contributions rise alongside the National Minimum Wage.

But with last week’s more positive economic growth numbers for February, with growth across all the main sectors, there are some signs of momentum in the economy that may push back against the effects of rising costs. At least before the sudden triggering of global tariff trade negotiations by the US in April 2025.

Commenting on today’s figures, REC Chief Executive Neil Carberry said:

“There’s no denying it feels tough to employ people as the cost of taking workers on rises, but businesses are resilient, and they continue to create opportunities. With a steady 1.6m active job adverts out there, employers are seeing glimmers of hope. The labour market is stabilising and February’s economic growth figures offered cautious optimism, while the UK looks relatively well-placed to weather some of the external shocks from shifting global trade policy.

“But employer confidence remains fragile. Government must do more to support growth with its upcoming industrial strategy, and by showing it is listening to business concerns about the way the Employment Rights Bill will work. Investment will stay stuck in neutral if all that is offered is warm words. Competitiveness matters to business, and the ability of the private sector to drive the growth that will solve the government’s fiscal headache.”

Sectors:

Agriculture:

Overall, the sector had a 4.2% increase in the number of job postings from February to March 2025. Most roles saw an increase in job postings, but Farmers had the biggest uptick in postings, rising 39.8% from the previous month making it the fastest rising role in the UK. Other such roles to show an increase in that period include Agricultural and Fishing Trades n.e.c. (16.7%) and Biological Scientists (7.9%) The only agriculture roles to decrease were Farm Workers (-1.7%) and Forestry Workers (-12.7%).

Blue Collar:

There were over 69,000 Blue Collar roles posted in March 2025. This is a 3.9% increase from February 2025. Overall, most Blue-Collar jobs saw an increase in March 2025 as compared to February 2025. The following were the roles with the biggest increase: Production Managers and Directors in Manufacturing (11.4%), Skilled Metal, Electrical and Electronic Trades Supervisors (8.8%) and Production, Factory and Assembly Supervisors (7.7%). The roles with the greatest falls in demand between February 2025 to March 2025 were Fork-lift Truck Drivers (-6.8%), Assemblers (Electrical and Electronic Products) (-4.5%) and Packers, Bottlers, Canners and Fillers (-3.5%).

Finance and Accounting:

In March 2025 there were over 87,000 job posts in the Finance and Accounting sector. This is an increase of 1.6% as compared to February 2025. Most roles in the Finance and Accounting sector saw an increase in job postings, including Finance and Investment Analysts and Advisers (9.2%), Purchasing Managers and Directors (9.2%), Insurance Underwriters (7.2%), Financial Accounts Managers (5.4%) and Business and Financial Project Management Professionals (3.7%). The only significant faller in roles was Financial Administrative Occupations n.e.c. (-12.9%).

Today’s Labour Market Tracker shows an increase in job postings this month for Farmers (39.8%), Delivery Drivers and Couriers (39.6%) and Rail Construction and Maintenance Operatives (29.1%).

Animal Care Services Occupations n.e.c.(-13.9%), Window Cleaners (-16.7%) and Probation Officers (-35.9%) all showed the largest decline in roles from February 2025 to March 2025.

East Dunbartonshire (24.0%), Argyll and Bute for the second month in a row saw the second highest increase in the number of job postings (Feb 2025 23.5% and March 2025 22.7%) and Central Bedfordshire (16.3%) showed the highest increase in job postings. Of the top 10 counties that had the highest increase in job postings nine were based in Scotland and Wales.

Whereas Fermanagh and Omagh (-10.8%), East Derbyshire (-11.7%) and Lisburn and Castlereagh (-14.1%) all accounted for the sharpest decline in job postings.

With the National Education Union (NEU) holding its annual conference this week, the REC/Lightcast report today shows 25,896 adverts for Secondary Education Teaching Professionals in March 2025 – up 5.8% on February 2025 - and 17,653 adverts for Primary Education Teaching Professionals – up 9.6% on February 2025.