- Job vacancies down 30% more than seasonal norm following budget NI tax increase

- Northern England sees larger than average jobs slowdown while London jobs market shows resilience

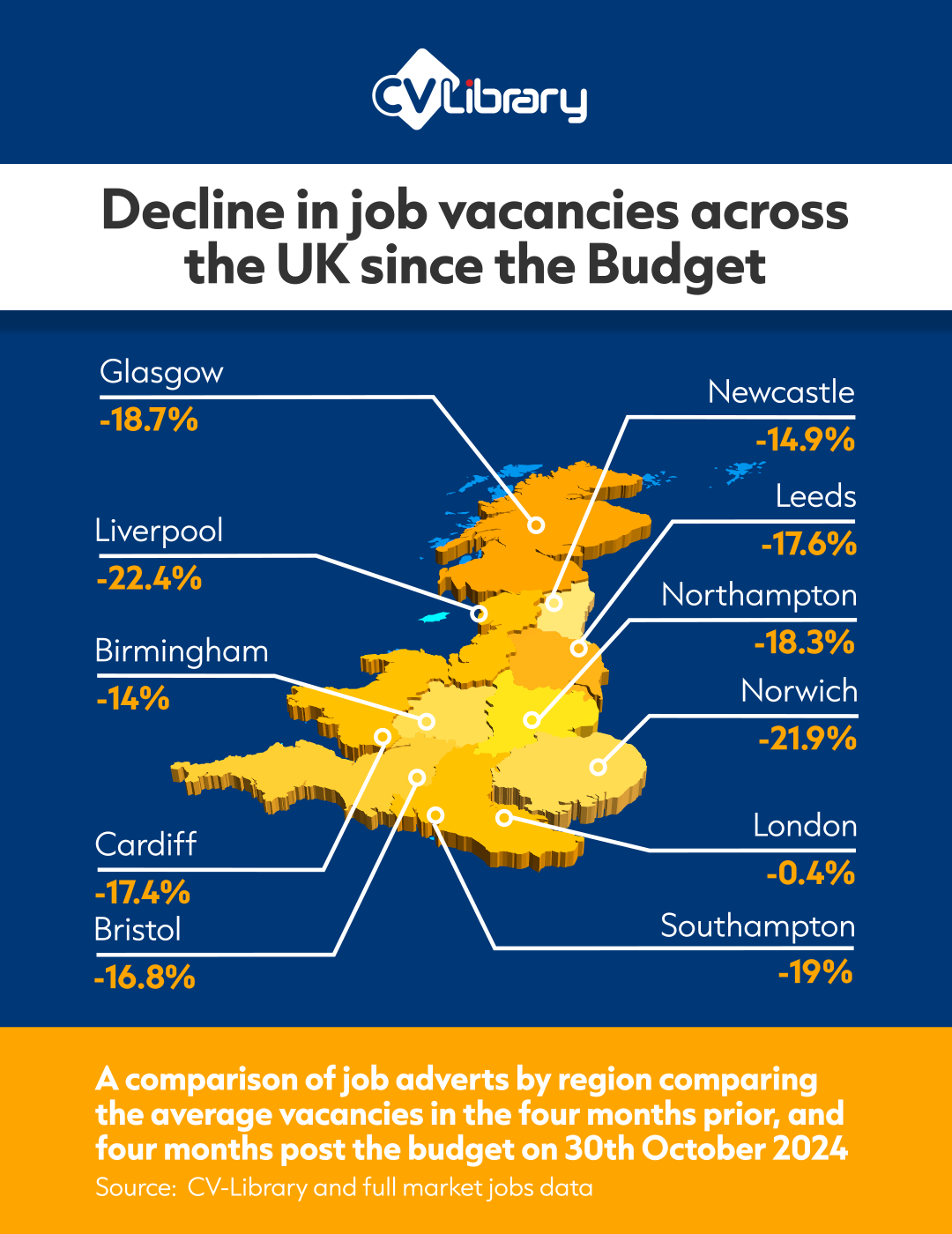

New data analysis from CV-Library, the UK’s largest independent job site, reveals a significant reduction in the number of job vacancies advertised since the Budget last October, and a widening of regional disparity in job creation.

Even before the increased employer NI tax rates take effect from 6th April, CV-Library's data analysis shows that businesses have already cut back on hiring in anticipation of higher costs, with the biggest cutbacks in the North of the country.

Across the country as a whole, job vacancies fell by 15.1% in the four months since the budget, compared to the prior four months. That represents an additional 30% reduction in job vacancies compared to seasonal norms (-11.5% reduction in job vacancies using the same period to period comparison in 2023-2024).

The data analysis also shows a big divide between London and the rest of the country.

The number of jobs advertised in the capital has remained largely flat compared to the period before the budget (-0.4%), while areas such as Nottingham, Liverpool, Norwich, Warrington and Sheffield have all seen more than a 20% drop in the number of jobs advertised since the end of October.

A full regional breakdown of job vacancies variances – a full analysis is here:

|

Ranking based on lowest drop in job vacancies to highest |

Region |

Difference in jobs advertised in four months pre and post budget |

|

|

Nationwide |

-15.1% |

|

1 |

London |

- 0.4% |

|

2 |

Birmingham |

- 14% |

|

3 |

Derby |

-14.4% |

|

4 |

Oxford |

-14.6% |

|

5 |

Edinburgh |

-14.8% |

|

6 |

Newcastle |

-14.9% |

|

7 |

Reading |

-15% |

|

8 |

Portsmouth |

-15.9% |

|

9 |

Bristol |

-16.8% |

|

10 |

Cambridge |

-16.8% |

|

11 |

Cardiff |

-17.4% |

|

12 |

Leeds |

–17.6% |

|

13 |

Manchester |

-18% |

|

14 |

Leicester |

-18% |

|

15 |

Northampton |

-18.3% |

|

16 |

Glasgow |

-18.7% |

|

17 |

Milton Keynes |

-18.9% |

|

18 |

Southampton |

-19% |

|

19 |

Coventry |

-19.2% |

|

20 |

Peterborough |

-19.2% |

|

21 |

Sheffield |

-20.9% |

|

22 |

Warrington |

–20.9% |

|

23 |

Norwich |

-21.9% |

|

24 |

Liverpool |

-22.4% |

|

25 |

Nottingham |

-22.9% |

Lee Biggins, CEO and Founder, CV-Library said:

“These figures make it clear that there has been an immediate response to the budget in anticipation of higher employment costs to come. There is no doubt the promised increase in NI costs has hit hiring.

“But it also shows the regional disparity in business confidence and highlights that the impact of this policy is felt hardest outside of London. Our analysis shows there is not much levelling up to be had from this policy.

“The question is what happens next. Most companies will have now done their cost analysis and will be planning for the increase in overhead from April. The hope is that this cost increase has been priced in for some time and hiring will stabilise in the new tax year.

“However, global growth signals remain depressed, and business confidence is stubbornly low. Until the costs start hitting the balance sheet, we just don’t know how businesses will respond to these higher costs. There is a high likelihood of higher prices as costs are passed through, lower wage growth and continued hiring squeezes.

“The next few months will be telling and hiring levels will be an important economic indicator.”

About the analysis:

- CV-Library analysed its own job posting data alongside the whole of the market job postings ingested from other sources.

- It compared the number of jobs advertised in the four-month period before the Autumn Budget (July-Oct 2024), with the subsequent four months (Nov 2024-Feb 2025).

- There is always a seasonal impact in comparing these two period with job adverts always dipping over the Christmas period, but the January and February months are typically among the busiest in terms of vacancies.

- To understand the budget impact, CV-Library compared the drop off in nationwide job postings in the period 2024-2025, with that of 2023-2024. There was a 30% greater reduction in jobs posted in 2024-2025 compared with the prior year.

- The regional breakdown shows the variation in job reduction from the nationwide average and highlights the strength of London’s job market compared to the rest of the country.