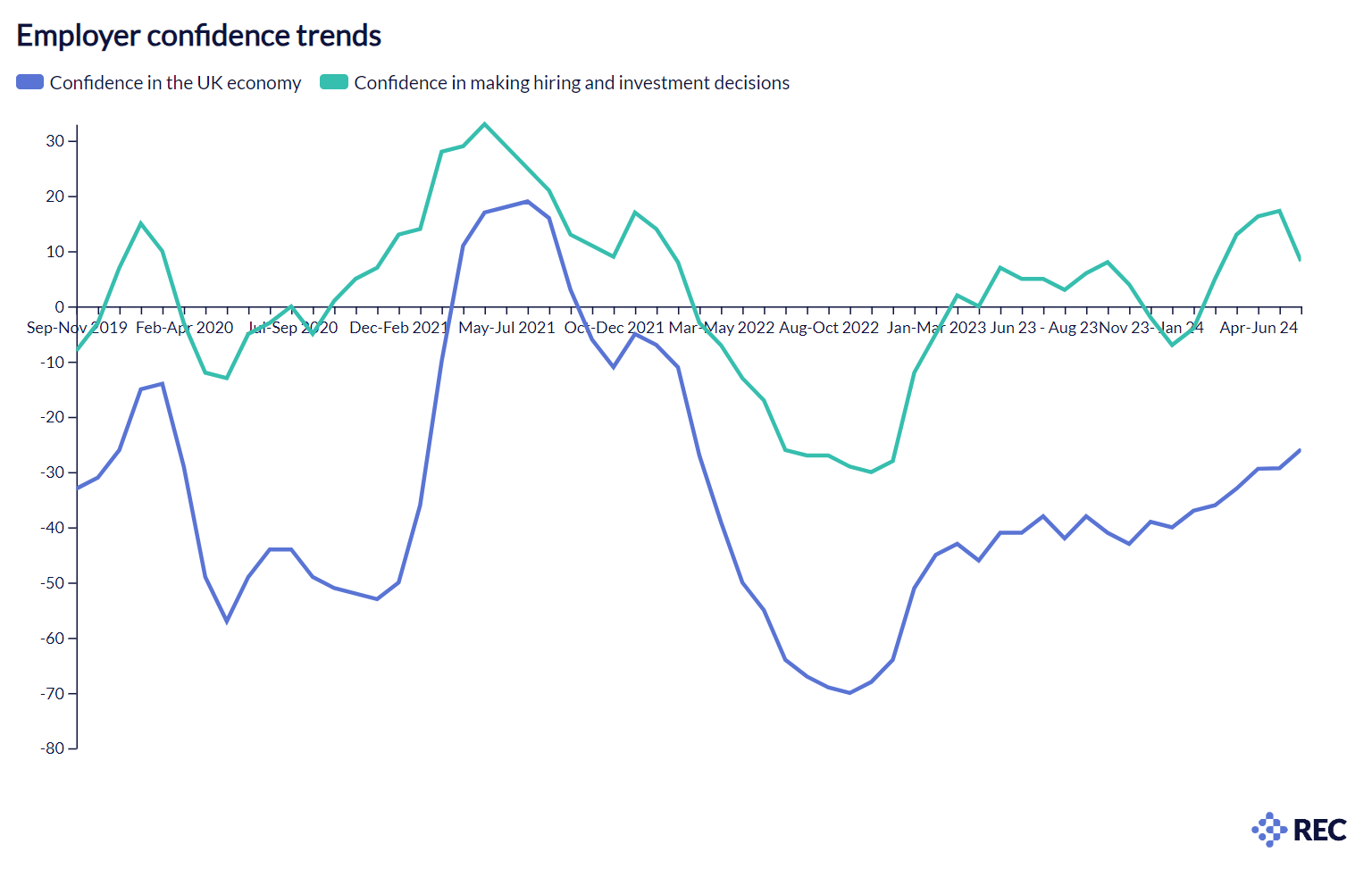

But it remains in negative territory going into the autumn. This longer than predicted stretch of economic caution also caused the pace at which firms’ confidence in their own business is improving to moderate a little (to +8). This was particularly driven by a marginal drop in confidence during August.

Overall, the Report shows hiring intentions remain positive for firms. It also shows that SMEs are more optimistic about temp recruitment in the short and medium-term, and some evidence of improving sentiment in London, which is always a labour market bellwether. Turning to temporary labour is a common way of weathering uncertain times for companies.

Neil Carberry, Chief Executive of the REC, said:

“Electing a new government with economic growth as major priority should be good news for businesses and there is some evidence of an improving trend in employer sentiment. But some of the challenges ahead that were widely discussed in August will also be weighing on employers’ minds. Boosting confidence to invest and create jobs – and removing barriers to doing so – should be a priority for the new government as Parliament returns.

“A strong industrial strategy, with the workforce and productivity at its heart, and a pragmatic approach to implementing employment rights reforms will go a long way to boosting business confidence this autumn.”

Compared to the three months to June, a five-point fall in the forecast demand for short-term (next three months) agency workers this quarter left the balance at net: +3. But employers in London (net: +18) and the remainder of the South (net: +16) are most optimistic about temp short-term hiring.

Micro/small (0-49 employees) and mid-sized (50-249 employees) enterprises were notably optimistic about needing short-term agency workers – at net: +20 and net: +18, respectively.

The medium-term (next four to 12 months) outlook for agency worker demand was positive at net: +1 and improved to net: +3 in the last month of the quarter (August). Micro/small (0-49 employees) and medium (50-249 employees) enterprises – at net: +12 and net: +10 respectively signalled for potential hiring in the medium term. London was a buoyant regional outlier at net: +16.

There was an overall fall of just three points this quarter to net: +14 in the permanent hiring outlook for the short-term. But in London 32% of surveyed employers plan to increase numbers, compared to a 19% UK average. In this quarter, the medium-term balance also declined by three points to net: +13.