- Median pay award for UK employees drops to 4%, with most new pay deals lower than in 2023

- Public sector pay awards outpace private sector as new government’s promised pay reviews take effect

The latest data from HR data and insights provider Brightmine shows that UK pay rises have hit the lowest mark since June 2022, while the majority of new pay deals are now lower than in 2023.

Brightmine’s analysis shows that the median basic pay award in the three months to the end of August 2024 was 4%, remaining the same as in the previous quarter (revised down from 4.5%). Almost three-quarters (72.7%) of matched sample pay awards in the latest quarter were worth less than the same group of employees received a year ago, with only one-in-10 (11.4%) being higher than last year.

Public sector pay rises outperforming private sector

Following the change in government, one of the first actions of the new Labour chancellor in July was to accept the recommendations of the pay review bodies, resulting in above-inflation pay rises for millions of public-sector workers.

Over the 12 months to the end of August 2024, the median pay award in the public sector sits at 6%, reflecting increases for several of the groups covered by the pay review bodies. By contrast, the median award across the private sector is more than 20% lower than the public sector, at 4.7%, over the same period.

Meanwhile, in other sectors, pay awards in the manufacturing-and-production sector continue to fall behind those across the services sector, with manufacturing at 3.8% versus the services sector rises at 4.3%.

Sheila Attwood, Brightmine senior content manager, data and HR insights, comments: “We knew that pay settlements were unlikely to maintain the levels seen in 2023. Employers that have made pay awards so far this year have already reacted to the falling inflation environment by putting in place lower pay awards than made last year. However, as we look to the future, HR leaders will need to be creative with benefits packages and developing competitive packages that aren’t purely focused on increased pay.”

Over this period, we also saw pay awards move ahead of retail prices index (RPI) inflation in November 2023, having lagged behind every month since January 2021. However, with the headline level of pay awards falling, the gap between the two measures is narrowing once more.”

Sheila Attwood, Brightmine senior content manager, data and HR insights, comments: “We knew that pay settlements were unlikely to maintain the levels seen in 2023. Employers that have made pay awards so far this year have already reacted to the falling inflation environment by putting in place lower pay awards than made last year. However, as we look to the future, HR leaders will need to be creative with benefits packages and developing competitive packages that aren’t purely focused on increased pay.”

Key latest rolling quarter findings:

Based on 67 pay settlements that came into effect between 1 June and 31 August 2024, covering 900,000 employees, Brightmine also found:

- Median falls back. In the three months to the end of August 2024, the median basic pay award stands at 4%. Although this is unchanged from the previous rolling quarter, that figure has been revised down from an originally reported 4.5%.

- Most common pay award back to 4%. Throughout the year the most common pay award sat at either 4% or 5%. In the latest rolling quarter, 20.3% of pay awards were worth exactly 4% compared with 18.6% (or just one more deal) sitting at exactly 5%.

- Bunching around the median demonstrates that pay awards are more stable than when inflation was at its peak. The middle 50% of pay awards are worth between 3.3% (the lower quartile) and 5% (the upper quartile). While representing a slightly wider gap than in the previous rolling quarter (3.5% to 5%), it still demonstrates a level of bunching around the median not seen over the past few years.

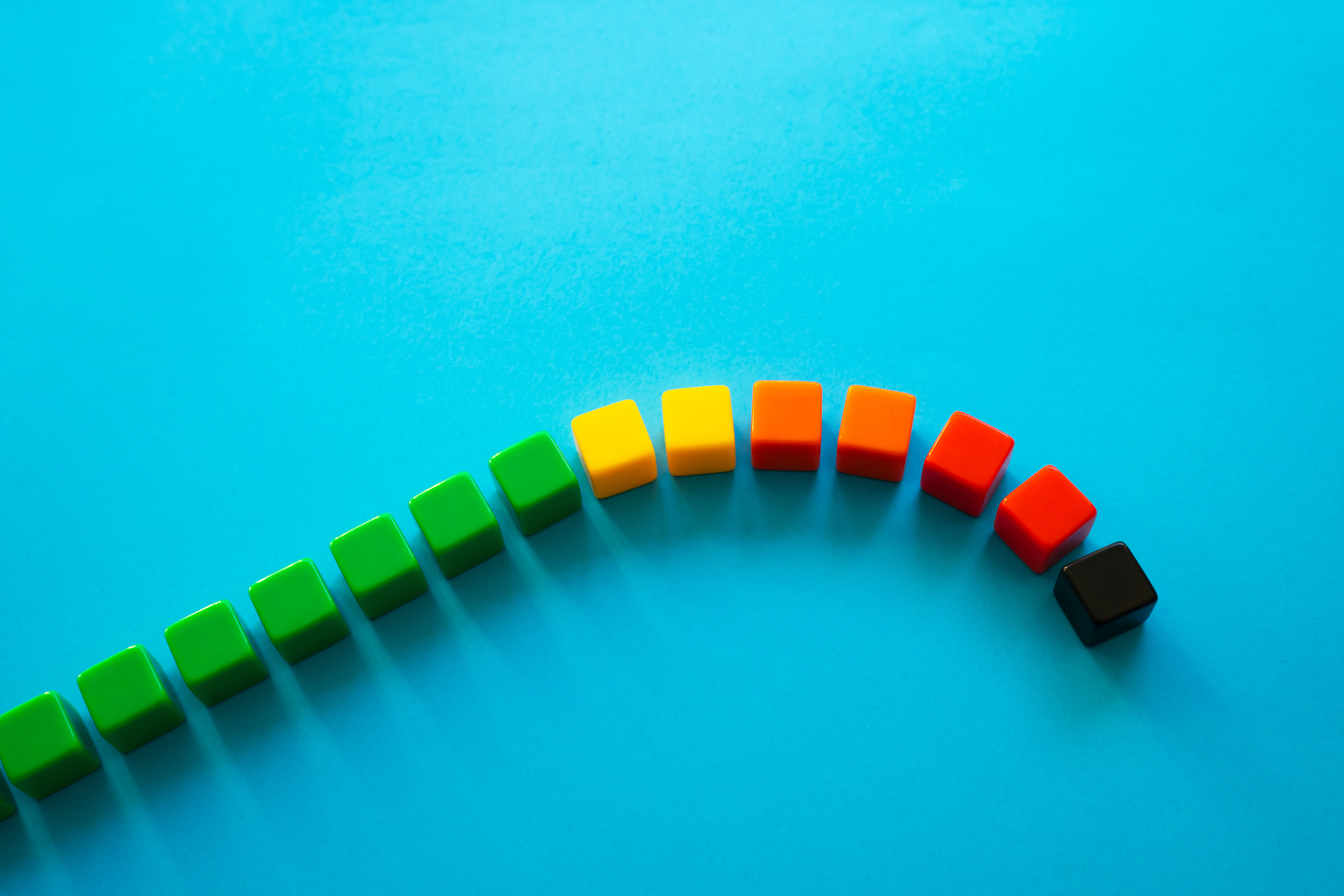

Pay review pattern - whole economy, August 2023 to August 2024

For more pay trends information for the rolling three months to the end of August, including sector insights, please click here.